1. Home Energy Audit

Type: Federal Tax Credit

Amount: 30% of the cost paid by the consumer, up to $150, is available through a federal tax credit.*

2. Electric Panel Upgrades

Type: Federal Tax Credit and State Rebates

Amount: 30% of the cost paid by the consumer, up to $600, is available through a federal tax credit if installed in conjunction with certain electrification or efficiency upgrades*

3. Electrical Wiring

Type: State Rebate

Amount: Income-based incentives will be announced through the federal Home Energy Rebates program (for households at or below 150% area median income).

4. Air-Source Heat Pump

Type: Federal Tax Credit and State Rebates

Amount: 30% of the cost paid by the consumer, up to $2,000/year, is available through a federal tax credit.*

5. Geothermal (Ground-Source) Heat Pump

Type: Federal Tax Credit and State Rebate

Amount: 30% of the cost paid by the consumer is available through a federal tax credit.

6. Heat Pump Clothes Dryer

Type: State Rebate

Amount: Income-based incentives will be announced through the federal Home Energy Rebates program (for households at or below 150% area median income).

7. Induction Cooktop

Type: State Rebate

Amount: Income-based incentives will be announced through the federal Home Energy Rebates program (for households at or below 150% area median income).

8. Heat Pump Water Heater

Type: Federal Tax Credit and State Rebate

Amount: 30% of the cost paid by the consumer, up to $2,000/year, is available through a tax credit.

9. Insulation and Air Sealing Materials

Type: Federal Tax Credit and State Rebate

Amount: 30% of the cost paid by the consumer is available through a federal tax credit.*

10. Energy-Efficient Exterior Doors

Type: Federal Tax Credit

Amount: 30% of the cost paid by the consumer, up to $500 per year (up to $250 per door), is available through a federal tax credit.*

11. Energy-Efficient Windows

Type: Federal Tax Credit

Amount: 30% of the cost paid by the consumer, up to $600/year, is available through a federal tax credit.*

12. Whole Home Energy Efficiency Upgrade

Type: State Rebate

Amount: Forthcoming state incentives will be announced through the federal Home Energy Rebates program administered by the Minnesota Department of Commerce.

13. Rooftop Solar At Home

Type: Federal Tax Credit

Amount: 30% of the cost paid by the consumer is available through a federal tax credit.

14. Battery Storage

Type: Federal Tax Credit

Amount: 30% of the cost paid by the consumer is available through a federal tax credit.

15. New Electric Vehicle

Type: Federal Tax Credit and State Rebate

Amount: Income-based federal tax credit available to individuals and businesses for new EVs purchased from 2023-2032, up to $7,500 depending upon whether the vehicle meets critical mineral and/or battery component requirements.

16. Used Electric Vehicle

Type: Federal Tax Credit and State Rebate

Amount: 30% of the sale price paid by the consumer, up to $4,000, is available through a federal tax credit. Vehicle must be bought from a participating dealer.

17. Electric Vehicle Charger

Type: Federal Tax Credit

Amount: 30% of the cost of hardware and installation paid by the consumer, up to $1,000, is available through a federal tax credit if consumer meets income-based and geographical requirements.

18. Minnesota E-Bike Rebate Program

Type: State Rebate

Amount: A rebate of up to 75% the sale price of a new e-bike, up to $1,500, is available through the state rebate program. The program is scaled to income and has limited funds available each year of operation.

19. Utility Incentives

Type: Utility Rebates

Amount: Your utility may offer a variety of rebates: Solar Rebates, EV Charger Rebates, Heat Pump Rebates, Insulation and Air Sealing Rebates, etc

20. Lawn Care/Snow Removal Equipment

21. Elective Pay (or Direct Pay)

Type: Federal reimbursement for some clean energy projects by non-taxed entities

Amount: Varies by tax credit, often 30% if project pays prevailing wage, without limit

About

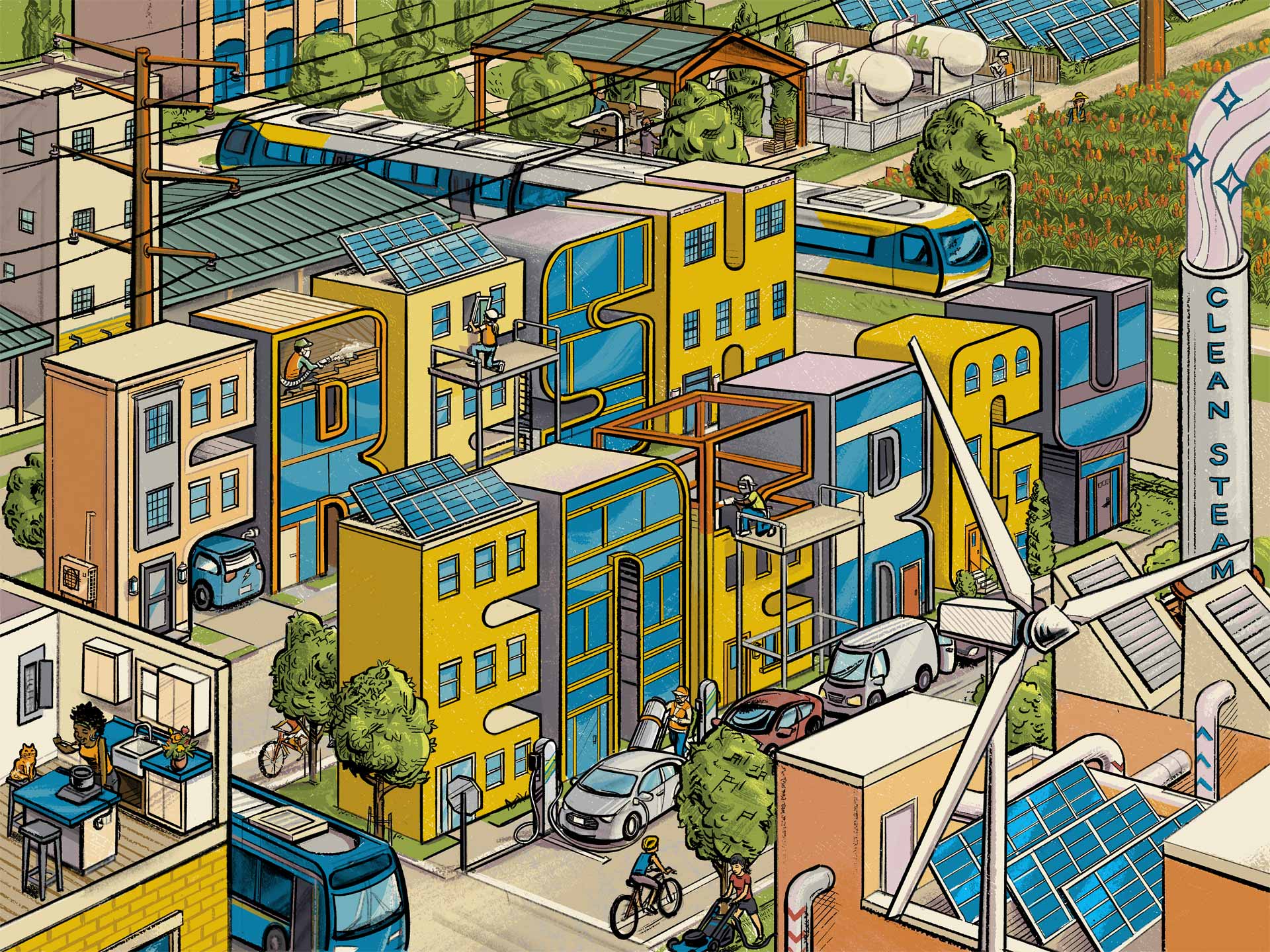

Every aspect of our lives, including our health and our financial well-being, is impacted by the climate emergency. But we can turn the tide on climate change! Already, by working together, we’ve made great progress in cleaning up how we generate electricity. We’re moving off of coal and gas and onto carbon-free resources like wind and solar. Now, it’s time for us to focus on transitioning everything else to be carbon neutral–this is called decarbonization!

Decarbonization means evolving how we get around as well as how we build, heat and cool, and cook in our homes. And don’t forget, we also need to decarbonize our industry and agriculture sectors, including how we manufacture our goods and materials and produce fertilizers. Decarbonizing these aspects of our lives doesn’t just address the climate emergency; it saves money, creates jobs, supports healthy communities, and repairs systemic inequities.

Fortunately, historic federal investments through the Inflation Reduction Act (IRA) and state investments are amping up these decarbonization efforts, and Fresh Energy has a team of experts dedicated to meeting the challenge. Learn more about Fresh Energy and sign up to get updates on the latest and greatest energy and climate news at fresh-energy.org.

Tips for using this resource

Do your homework! This resource is intended to help you on your decarbonization journey by giving you some high-level details about state and federal assistance that, depending upon your eligibility, may be available. Do not use this as your only source of information! Set aside time to do your own research and remember, some categories of incentives on this page are subject to cumulative, annual caps grouped by type. Some have income limits. Additionally, some categories of incentives are renter eligible, while some are not.

Make a plan. If you’re not sure where to start and even if you think you know, it’s smart to begin with a Home Energy Audit, which will give you the information you need to start making a plan. If you are renting your home, use this resource to start a conversation with your building owner about energy efficiency and electrification!

Both tax credits and rebates are listed on this site. Many of the rebate programs have not yet launched at the time of printing. When they do launch, pay close attention to the eligibility guidelines and any deadlines as funds may be limited.

Remember! Tax credits will come into play the following tax year after your purchase and you will need to know your tax liability to calculate your benefit from tax credits.

And don’t forget about utility rebates. Many utilities offer rebates to help you decarbonize. Check your local electric and gas utilities for more information on these “stackable” rebates!

List View

1. Home Energy Audit

Type: Federal Tax Credit

Amount: 30% of the cost paid by the consumer, up to $150, is available through a federal tax credit.*

Period: 2023-2032 Ends December 31, 2025

Access: Submit IRS Form 5695 when filing your taxes if you meet the requirements detailed on IRS.gov.

More Information: energy.gov/save/homeowners

2. Electric Panel Upgrades

Type: Federal Tax Credit and State Rebates

Amount:

- 30% of the cost paid by the consumer, up to $600, is available through a federal tax credit if installed in conjunction with certain electrification or efficiency upgrades*

- Additional income-based incentives will be announced through the federal Home Energy Rebates program (for households at or below 150% area median income).

- Thanks to action at the Minnesota Legislature, extra state funding is also available to extend the impact of federally funded electric panel rebates (for households at or below 150% area median income).

Period: 2023-2032 for federal tax credit Ends December 31, 2025; state rebates expected 2025

Access:

- For the federal tax credit, submit IRS Form 5695 when filing your taxes if you meet the requirements detailed on IRS.gov.

- Stay tuned as the federal Home Energy Rebates programs are deployed nationwide and administered through Minnesota’s State Energy Office at the Minnesota Department of Commerce. At the time of printing, these state-administered rebates for electric panel or circuit upgrades for new electric equipment are not yet available.

- The Department of Commerce will be administering state-allocated rebates established by the Minnesota Legislature. At the time of printing, this rebate program has not yet launched.

More Information: energy.gov/save/homeowners and mn.gov/commerce/energy/consumer/energy-programs/residential-electrical-panel-upgrades.jsp

3. Electrical Wiring

Type: State Rebate

Amount: Income-based incentives will be announced through the federal Home Energy Rebates program (for households at or below 150% area median income).

Period: Expected 2025

Access: Stay tuned as the federal Home Energy Rebates programs are deployed nationwide and administered through Minnesota’s State Energy Office at the Minnesota Department of Commerce. At the time of printing, these state-administered rebates for electrical wiring are not yet available.

More information: energy.gov/save/homeowners

4. Air-Source Heat Pump

Type: Federal Tax Credit and State Rebates

Amount:

- 30% of the cost paid by the consumer, up to $2,000/year, is available through a federal tax credit.*

- Additional income-based incentives will be announced through the federal Home Energy Rebates program (for households at or below 150% area median income).

- Thanks to action at the Minnesota Legislature, extra state funding is also available to extend the impact of federally funded air-source heat pump rebates (for households at or below 150% area median income).

Period: 2023-2032 for federal tax credit Ends December 31, 2025; state rebates expected 2025

Access:

- For the federal tax credit, submit IRS Form 5695 when filing your taxes if you meet the requirements detailed on IRS.gov.

- Stay tuned as the federal Home Energy Rebates programs are deployed nationwide and administered through Minnesota’s State Energy Office at the Minnesota Department of Commerce. At the time of printing, these state-administered rebates for air-source heat pumps are not yet available.

- The Department of Commerce will be administering state-allocated rebates established by the Minnesota Legislature. At the time of printing, this rebate program has not yet launched.

More Information: energy.gov/save/homeowners and mn.gov/commerce/energy/consumer/energy-programs/heat-pump.jsp

5. Geothermal (Ground-Source) Heat Pump

Type: Federal Tax Credit and State Rebate

Amount:

- 30% of the cost paid by the consumer is available through a federal tax credit.

- Additional income-based incentives will be announced through the federal Home Energy Rebates program (for households below 150% area median income).

Period: 2023-2032 for federal tax credit Ends December 31, 2025; state rebate expected 2025

Access:

- For the federal tax credit, submit IRS Form 5695 when filing your taxes if you meet the requirements detailed on IRS.gov.

- Stay tuned as the federal Home Energy Rebates programs are deployed nationwide and administered through Minnesota’s State Energy Office at the Minnesota Department of Commerce. At the time of printing, these state-administered rebates for geothermal heat pumps are not yet available.

More Information: energy.gov/save/homeowners

6. Heat Pump Clothes Dryer

Type: State Rebate

Amount: Income-based incentives will be announced through the federal Home Energy Rebates program (for households at or below 150% area median income).

Period: Expected 2025

Access: Stay tuned as the federal Home Energy Rebates programs are deployed nationwide and administered through Minnesota’s State Energy Office at the Minnesota Department of Commerce. At the time of printing, these state-administered rebates for heat pump clothes dryers are not yet available.

More Information: energy.gov/save/homeowners

7. Induction Cooktop

Type: State Rebate

Amount: Income-based incentives will be announced through the federal Home Energy Rebates program (for households at or below 150% area median income).

Period: Expected 2025

Access: Stay tuned as the federal Home Energy Rebates programs are deployed nationwide and administered through Minnesota’s State Energy Office at the Minnesota Department of Commerce. At the time of printing, these state-administered rebates for induction cooktops are not yet available.

More Information: energy.gov/save/homeowners

8. Heat Pump Water Heater

Type: Federal Tax Credit and State Rebate

Amount:

- 30% of the cost paid by the consumer, up to $2,000/year, is available through a tax credit.

- Additional income-based incentives will be announced through the federal Home Energy Rebates program (for households below 150% area median income).

Period:2023-2032 for federal tax credit Ends December 31, 2025; state rebate expected 2025

Access:

- For the federal tax credit, submit IRS Form 5695 when filing your taxes if you meet the requirements detailed on IRS.gov.

- Stay tuned as the federal Home Energy Rebates programs are deployed nationwide and administered through Minnesota’s State Energy Office at the Minnesota Department of Commerce. At the time of printing, these state-administered rebates for heat pump water heaters are not yet available.

More Information: energy.gov/save/homeowners

9. Insulation and Air Sealing Materials

Type: Federal Tax Credit and State Rebate

Amount:

- 30% of the cost paid by the consumer is available through a federal tax credit.*

- Additional income-based incentives will be announced through the federal Home Energy Rebates program (for households at or below 150% area median income).

Period: 2023-2032 Ends December 31, 2025, state rebate expected 2025

Access:

- For the federal tax credit, submit IRS Form 5695 when filing your taxes if you meet the requirements detailed on IRS.gov.

- Stay tuned as the federal Home Energy Rebates programs are deployed nationwide and administered through Minnesota’s State Energy Office at the Minnesota Department of Commerce. At the time of printing, these state-administered rebates for insulation and air sealing materials are not yet available.

More Information: energy.gov/save/homeowners

10. Energy-Efficient Exterior Doors

Type: Federal Tax Credit

Amount: 30% of the cost paid by the consumer, up to $500/year (up to $250/ door), is available through a federal tax credit.*

Period: 2023-2032 Ends December 31, 2025

Access: Submit IRS Form 5695 when filing your taxes if you meet the requirements detailed on IRS.gov.

More Information: energy.gov/save/homeowners

11. Energy-Efficient Windows

Type: Federal Tax Credit

Amount: 30% of the cost paid by the consumer, up to $600/year, is available through a federal tax credit.*

Period: 2023-2032 Ends December 31, 2025

Access: Submit IRS Form 5695 when filing your taxes if you meet the requirements detailed on IRS.gov.

More Information: energy.gov/save/homeowners

12. Whole Home Energy Efficiency Upgrade

Type: State Rebate

Amount: Forthcoming state incentives will be announced through the federal Home Energy Rebates program administered by the Minnesota Department of Commerce.

Period: Expected 2025

Access: Stay tuned as the federal Home Energy Rebates programs are deployed nationwide and administered through Minnesota’s State Energy Office at the Minnesota Department of Commerce. At the time of printing, these whole home energy efficiency rebates are not yet available. Only projects with expected energy savings of 20% or more will qualify.

More Information: energy.gov/save/homeowners

13. Rooftop Solar At Home

Type: Federal Tax Credit

Amount: 30% of the cost paid by the consumer is available through a federal tax credit.

Period: 2023-2032 Ends December 31, 2025

Access: Submit IRS Form 5695 when filing your taxes if you meet the requirements detailed on IRS.gov.

More Information: energy.gov/save/homeowners

14. Battery Storage

Type: Federal Tax Credit

Amount: 30% of the cost paid by the consumer is available through a federal tax credit.

Period: 2023-2032 Ends December 31, 2025

Access: Submit IRS Form 5695 when filing your taxes if you meet the requirements detailed on IRS.gov.

More Information: energy.gov/save/homeowners

15. New Electric Vehicle

Type: Federal Tax Credit and State Rebate

Amount:

- Income-based federal tax credit available to individuals and businesses for new EVs purchased from 2023-2032, up to $7,500 depending upon whether the vehicle meets critical mineral and/or battery component requirements.

- Thanks to action at the Minnesota Legislature, state funding is also available for new EV rebates. A new electric vehicle with a cost of $55,000 base MSRP or less could qualify for a state rebate up to $2,500, if purchased on or after May 25, 2023.

Period:2023-2032 for federal tax credit Ends September 30, 2025; state rebate launched February 2024 and will close when all available rebates are disbursed.

Access:

- For the federal tax credit, submit IRS Form 8936 when filing your taxes if you meet the requirements detailed on IRS.gov.

- For the state program, submit an application at the Minnesota Department of Commerce.

More Information: https://fueleconomy.gov/feg/tax2022.shtml and mn.gov/commerce/energy/consumer/energy-programs/ev-rebates.jsp.

16. Used Electric Vehicle

Type: Federal Tax Credit and State Rebate

Amount:

- 30% of the sale price paid by the consumer, up to $4,000, is available through a federal tax credit. Vehicle must be bought from a participating dealer.

- Income-based federal tax credit available starting January 1, 2023.

- Thanks to action at the Minnesota Legislature, state funding is also available for a rebate for an electric vehicles purchased on or after May 24, 2023. Used electric vehicle with a cost of $25,000 or less could qualify for a state rebate up to $600.

Period: Variable for federal tax credit Ends September 30, 2025; state rebate launched February 2024 and will close when all available rebates are disbursed.

Access:

- For the federal tax credit, submit IRS Form 8936 when filing your taxes if you meet the requirements detailed on IRS.gov.

- For the state program, submit an application for a used EV via the Minnesota Department of Commerce.

- Given the popularity of the state EV rebates, rebates are likely to be reserved quickly.

More Information: https://mn.gov/commerce/energy/consumer/energy-programs/ and mn.gov/commerce/energy/consumer/energy-programs/ev-rebates.jsp

17. Electric Vehicle Charger

Type: Federal Tax Credit

Amount: 30% of the cost of hardware and installation paid by the consumer, up to $1,000, is available through a federal tax credit if consumer meets income-based and geographical requirements.

Period: 2023-2032 Ends June 30, 2026

Access: Submit IRS Form 8911 when filing your taxes if you meet the requirements detailed on IRS.gov.

More Information: chargepoint.com/drivers/home/tax-credit/

18. Minnesota E-Bike Rebate Program

Type: State Rebate

Amount: A rebate of up to 75% the sale price of a new e-bike, up to $1,500, is available through the state rebate program. The program is scaled to income and has limited funds available each year of operation.

Period: 2024 and 2025

Access: The Minnesota Department of Revenue launched an online application portal.

More Information: revenue.state.mn.us/electric-assisted-bicycle-e-bike-rebate

19. Utility Incentives

Type: Utility Rebates

Amount: Your utility may offer a variety of rebates:

- Solar Rebates

- EV Charger Rebates

- Heat Pump Rebates

- Insulation and Air Sealing Rebates

- Residential Energy Efficiency Rebates

- Commercial and Industrial Energy Efficiently Rebates

- Electric Lawn Equipment Rebates

Period: Varies by utility

Access: Varies by utility

More Information: Check with your utility and the DSIRE Database at programs.dsireusa.org/system/program/mn. Search for air-source heat pump rebates by your utility using MN Air Source Heat Pump Collaborative’s database: mnashp.org/utility-rebates.

20. Lawn Care/Snow Removal Equipment

Type: State Grant and/or Rebate

Amount: TBD

Period: TBD – June 30, 2027

Access: Thanks to action at the Minnesota Legislature, the Minnesota Pollution Control Agency will administer state allocated rebates to eligible applicants to purchase electric lawn and snow removal equipment. Applicants living in environmental justice areas will be d. Access and details are to be determined.

21. Elective Pay (or Direct Pay)

Type: Federal reimbursement for some clean energy projects by non-taxed entities

Amount: Varies by tax credit, often 30% if project pays prevailing wage, without limit

Period: 2023-2032

Access: Elective Pay makes a number of energy related tax credits available to non-taxed entities like cities, nonprofits, tribes, churches, and beyond, as direct payments. Organizations must register with the IRS Energy Credits Online portal. Spread the word with your synagogue, nonprofit community organization, city administrator, or other tax-exempt organization.

More Information:

- https://www.cleanenergyresourceteams.org/what-you-need-know-about-ira-electivedirect-pay

- List of available credits: https://www.irs.gov/pub/irs-pdf/p5817g.pdf

- Energy Credits Online portal: https://www.irs.gov/credits-deductions/register-for-elective-payment-or-transfer-of-credits